Also with the added yield the bond trades at a premium in the secondary market for a price of 1100 per bond. This is classified as a liability on the books of the issuer and is amortized to interest expense over the remaining life of the bonds.

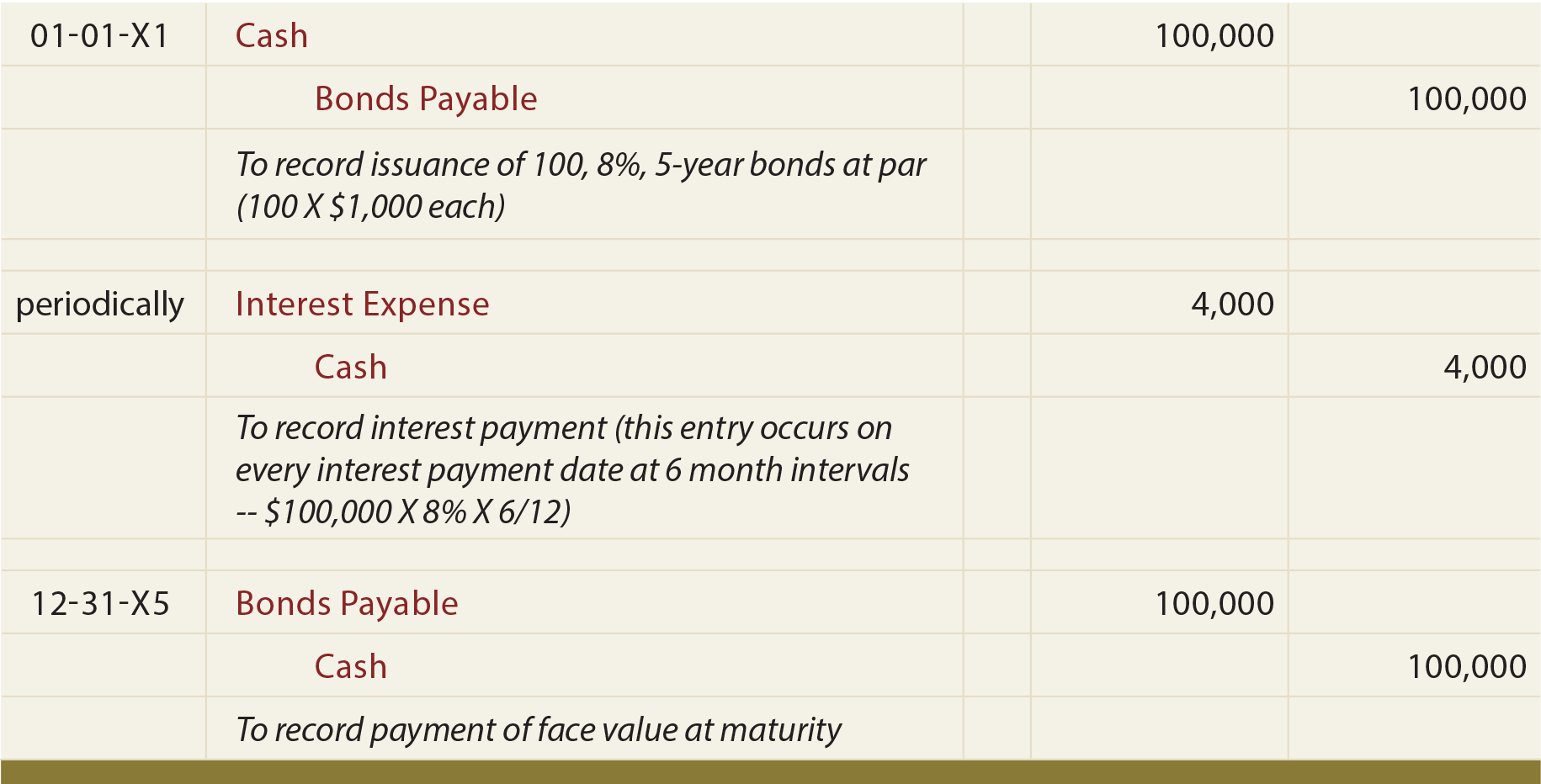

For example a bond with a stated interest rate of 8 is sold.

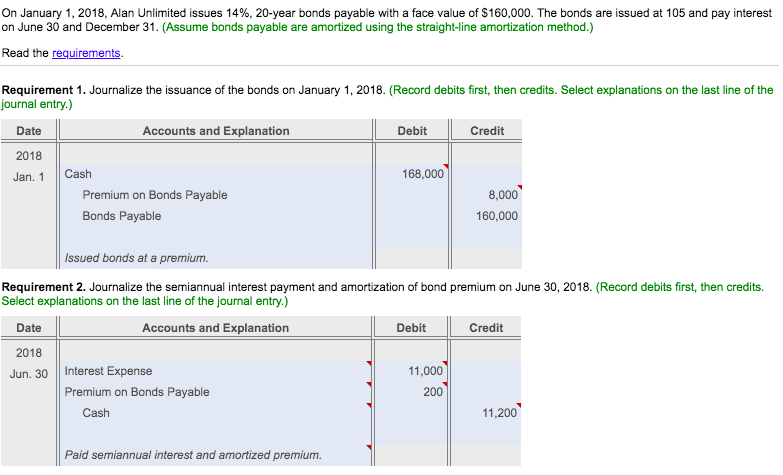

Premium bonds payable. Is discount on bonds payable. Bonds Payable Issued at Premium Journal Entry The bonds payable would be issued at a premium value of 108111 and the journal entry to record this would be as follows. Premium on bonds payale 4113.

This is classified as a liability and is amortized to interest expense over the remaining life of the bonds. Continue reading Bond premium. The balance of premium on bonds payable will be included in financial liability-bonds.

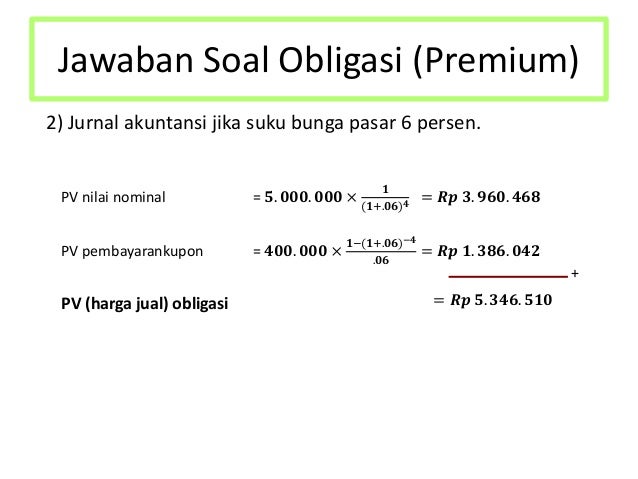

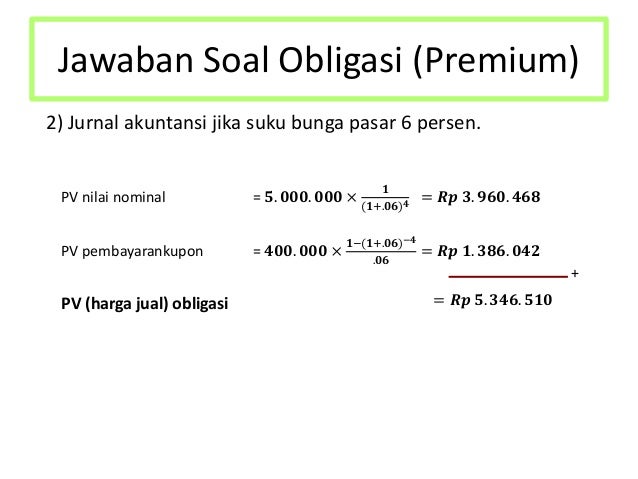

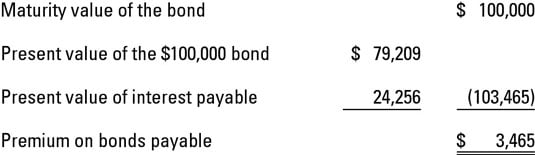

To illustrate the premium on bonds payable lets assume that in early December 2019 a corporation has prepared a 100000 bond with a stated interest rate of 9 per annum 9 per year. What is premium on bonds payable. Issued 62500000 of 10-year 9 bonds at a market effective interest rate of 8 receiving cash of 66747178.

Interest expense 5887. Cash 10000 Discount journal entries for 2008. Produces and sells outdoor equipment.

On July 1 2016 Saverin Inc. Discount on bonds payable 6074. Bonds Payable Issued at a premium.

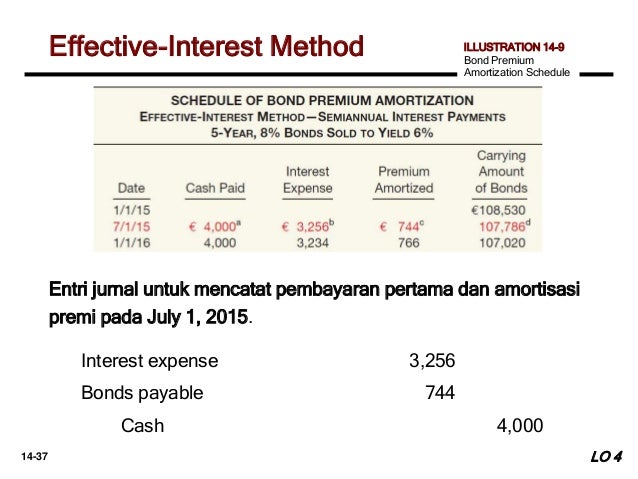

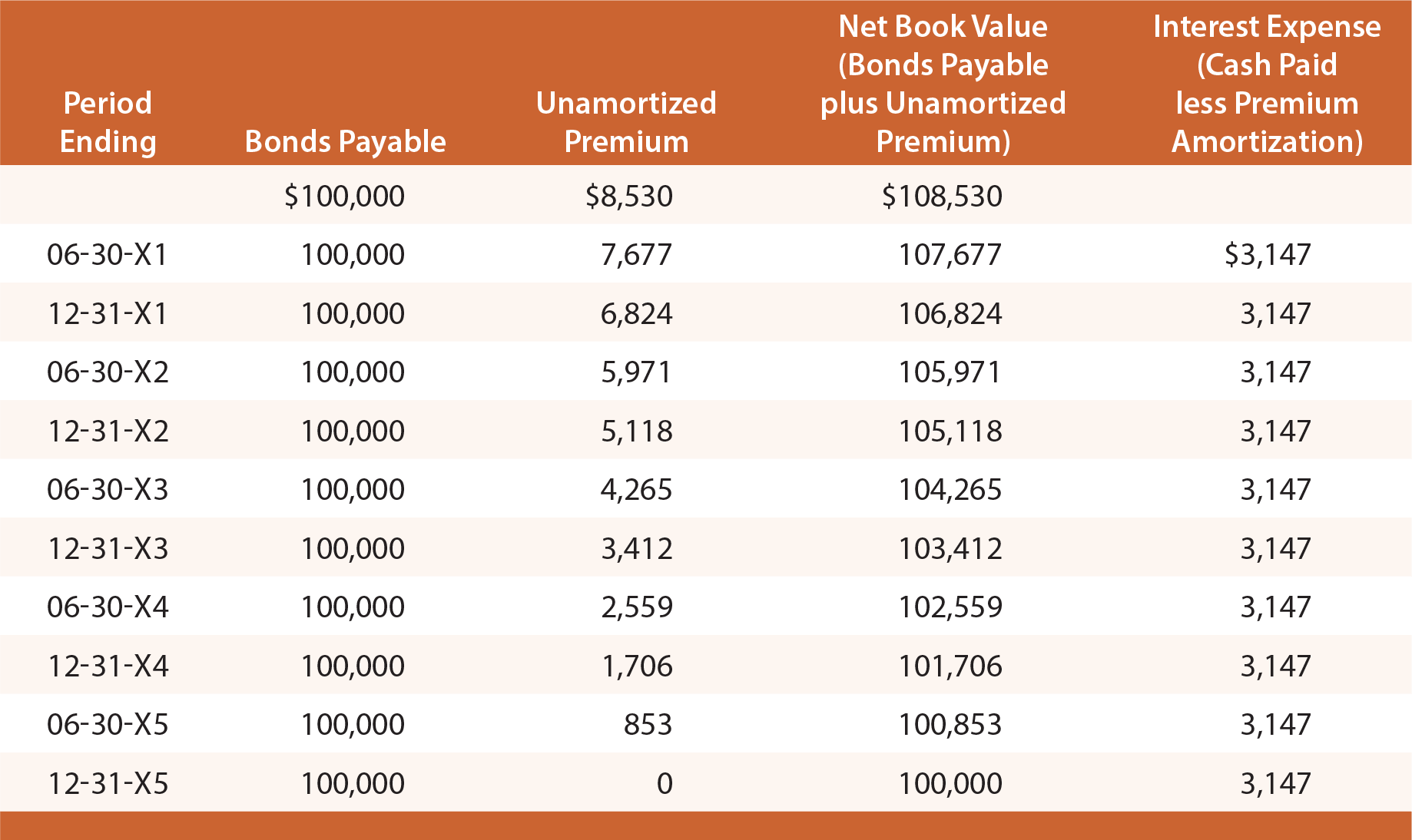

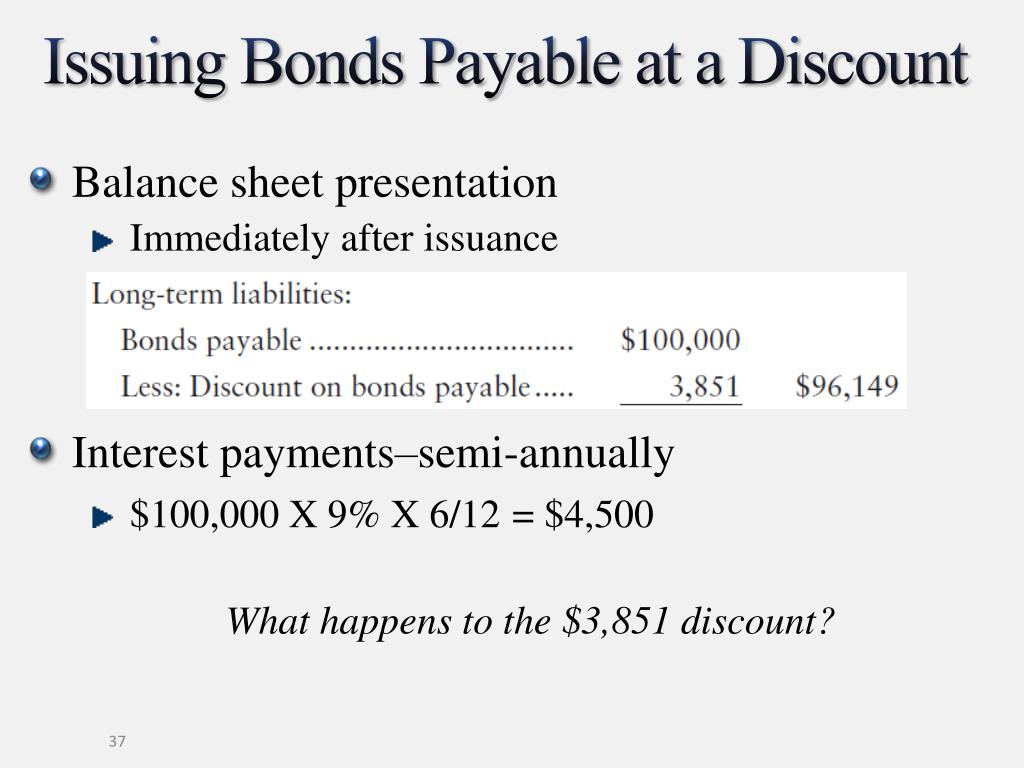

A premium on bond occurs when the bonds par value is lower than the issue price or carrying value. Study the following illustration and observe that the Premium on Bonds Payable is established at 8530 then reduced by 853 every interest date bringing the final balance to zero at maturity. This is caused by the bonds having a stated interest rate that is higher than the market interest rate for similar bonds.

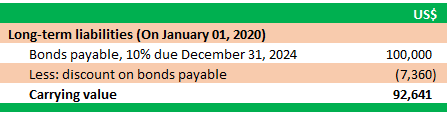

As the balance in the premium on bonds payable account declines over time this means that the net amount of the bonds payable account and premium on bonds payable account presented in the balance sheet will gradually decrease until it is 10000000 as of the date when the bonds are to be repaid to investors. Premium on bonds payable 17730. So on the balance sheet carry value is 102577 which is the present value of cash flow.

In return bondholders would be paid 5 per year for their investment. Home Accounting Dictionary What is a Premium on Bonds Payable. Like the discount situation we looked at in our other article this raises three issues we need to look at.

The amount received for the bond excluding accrued interest that is in excess of the bonds face amount is known as the premium on bonds payable bond premium or premium. Premium on bonds payable is the excess amount by which bonds are issued over their face value. What is a Premium on Bonds Payable.

Premium on bonds payable is the excess amount by which bonds are issued over their face value. Interest on the bonds is payable semiannually on December 31 and. Premium on bonds payable is the excess amount by which bonds are issued over their face value.

The difference between these two numbers is considered the bond premium. In this case investors are willing to pay extra for the bond which creates a premium. The net effect of this amortization is to reduce the amount of interest expense associated with the bonds.

This is classified as a liability and is amortized to interest expense over the remaining life of the bonds. What is a Premium on Bonds Payable. A premium on a bonds issue arises when the interest rate being paid on the bond referred to as the coupon rate is higher than the equivalent market interest rate at the moment.

Premium on bonds payable or bond premium occurs when bonds payable are issued for an amount greater than their face or maturity amount. At the end of the third year premium bonds payable will be zero and the carrying amount of bonds payable will be 100000. A premium on a bonds issue arises when the interest rate being paid on the bond referred to as a the coupon rate is higher than the equivalent market interest rate at the moment.

Premium on bonds payable is the excess amount by which bonds are issued over their face value. This is classified as a liability on the books of the issuer and is amortized to interest expense over the remaining life of the bonds. Like the discount situation we looked at in our other article this raises three issues we need to look at.

Bond premium entries for bonds payable transactions interest method of amortizing bond premium Saverin Inc.

Pengantar Akuntansi 2 Bonds Payable

Accounting For Bonds Payable Principlesofaccounting Com

Obligasi Kewajiban Tidak Lancar Creative And Addictive Education

Ppt Long Term Liabilities Bonds Payable And Classification Of Liabilities On The Balance Sheet Powerpoint Presentation Id 1672705

Journal Entry For Bonds Accounting Hub

Ppt Long Term Liabilities Bonds Payable And Classification Of Liabilities On The Balance Sheet Powerpoint Presentation Id 1672705

Bonds Payable In Accounting Double Entry Bookkeeping

Premium On Bonds Payable Example Youtube

How To Record Bonds Issued At A Premium Dummies

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Accounting For Bonds Payable Principlesofaccounting Com

Ppt Long Term Liabilities Bonds Payable And Classification Of Liabilities On The Balance Sheet Powerpoint Presentation Id 1672705

Obligasi Kewajiban Tidak Lancar Creative And Addictive Education

Accounting For Bonds Payable Principlesofaccounting Com

What Were The Calculations That Were Done To Get Chegg Com

Obligasi Kewajiban Tidak Lancar Creative And Addictive Education